when does alimony end in canada

Tv star Parker Schnabel was born on July 22 1994 to parents Roger and Nancy Schnabel. Other debts are included when you calculate based on the 36 back-end DTI limit.

When Does Child Support End In Canada Family Lawyer Winnipeg

Alimony also called aliment Scotland maintenance England Ireland Northern Ireland Wales Canada New Zealand spousal support US Canada and spouse maintenance Australia is a legal obligation on a person to provide financial support to their spouse before or after marital separation or divorceThe obligation arises from the divorce law or family law of each country.

. As we approach the end of the year its a good idea to think about personal income tax planning now so that you can maximize tax savings in 2021 and be prepared when final tax payments are due. Such amounts also wont be includible in the income of the recipient. If you did not apply within 36 months after the end of your marriage your pension credits can be divided only if your former spouse is still alive and agrees.

For example if your order or agreement specifically provides that spousal support is to end on December 1st of the year 2020 then your spousal support obligation would end at that time. Earned income is taxable and the rate is chosen based on the individuals or couples income bracket. The original concept of a common-law marriage is one considered valid by both partners but not.

Trial permanent and legal. Except for Quebec the information here applies in all provinces in Canada namely Ontario British Columbia Alberta Saskatchewan. Pensions or annuities.

I sent the form but I would like to have 2 or 3 refund proposals. Directed by Anthony Minghella. In addition if you have a question that is not answered here please feel free to contact us for more information.

This form may be obtained on request from any district office. Helpful articles for all Americans. Other obligations and subscriptions.

As of 2021 Parker is 27 years old and single. Legal Beagle is a keen astute resource for legal explanations. The person receiving the alimony does not.

Since individuals are taxed on a calendar year basis Dec. A means of dividing assets and providing for spousal support The most common type of postnuptial agreement spells out how a couples assets and liabilities would be divided in the event of a divorce. Indian Army Officer Dies By Suicide Within One Year Of Marriage As Wife In-Laws Allegedly Harassed Him Rs 15 Lakh Alimony by Team MDO February 10 2022 HIGH COURT.

Get the latest NASCAR news rumors video highlights scores schedules standings photos images player information and more from Sporting News. Common-law marriage also known as non-ceremonial marriage sui iuris marriage informal marriage or marriage by habit and repute is a legal framework where a couple may be considered married without having formally registered their relation as a civil or religious marriage. There are generally three different but related types of postnuptial agreements in the United States today.

In most states only one legal separation changes your legal statusbut all three have the potential to affect your legal. But note that this does not factor in your other debt obligations. With Matt Dillon Annabella Sciorra Mary-Louise Parker William Hurt.

The same is true of alimony paid under a divorce or separation instrument executed before 2019 and modified after 2018 if the modification expressly states that the alimony isnt deductible to the payer or includible in the income of the recipient. Every case is different merely reading the information on our website does not create an attorney-client relationship. 31 2021 is generally the last date for transactions that affect 2021 personal income taxes.

Alimony Alimony In family law alimony aliment in Scotland maintenance in UK and Canada spousal support in the United States spouse maintenance in Australia is a legal. In an attempt to end alimony payments a working class man tries to set up his ex wife with potential husbands. Although a separation doesnt end your marriage it does affect the financial responsibilities between you and your spouse before the divorce is final.

Today alimony or separate maintenance payments relating to any divorce or separation agreements dated January 1 2019 or later are not tax-deductible by the person paying the alimony. I think I can pay around 200 a month. This results in a minimum required salary of 9808387.

Learn more about the free information about divorce and separation available from Justice Canada in this short video or visit our website. The firm does not necessarily endorse and is not responsible for any third-party content that may be accessed through this website. My boyfriend left for 5 months and I had to pay my expenses alone.

The form of legal separation that is most common today in NY does not qualify a taxpayer to file as unmarried for the IRS. The information in this guide summarizes user-submitted testimonials online reviews and product descriptions to provide you with a candid and comprehensive look at the different payroll options available. I have not researched all 50 states but I am not aware of any state where their particular form of legal separation actually meets IRS requirements to be considered unmarried.

To help you narrow things down and choose the right payroll provider weve created a handy guide to the best payroll software in Canada. Based on the results the minimum required annual salary based on the 28 front-end DTI limit for a 260000 mortgage is 6610784. Alimony in California Questions and Answers California Alimony Laws.

A non-resident of Canada receiving pensions alimony or similar payments see 53e above from sources in Canada may file an Application by a Non-Resident of Canada for a Reduction in the Amount of Non-Resident Tax Required to be Withheld form NR5. It will also teach you how to seek appropriate court orders to put an end to it. This article is quite long but hopefully covers everything you need to know about alimony which in Canada is called spousal support.

Also use the minimum payment when calculating credit cards. The sum of the above is your monthly obligation. We do not consult with nor represent any.

The Canada Pension Plan credit split did not exist before January 1 1978. And remember to include taxes insurance and private mortgage insurance in this figure. These agreements also address alimony or spousal support and often.

In addition he only pays me a small alimony so I have several bills late. This number will be compared against your income to calculate your back end ratio. I need a 5000 loan to get out.

This websites content is solely for residents of California or residents of the United States or Canada who have a family law matter in California. If youre the spouse who is paying alimony you can take a tax deduction for the payments even if you dont itemize your deductions as long as your divorce agreement was finalized prior to 2019. There are three types of separation.

Keep in mind though that the IRS wont consider the payments to be true alimony unless they are made in cash and are required by a divorce agreement. Take control understand your rights and become a legal beagle.

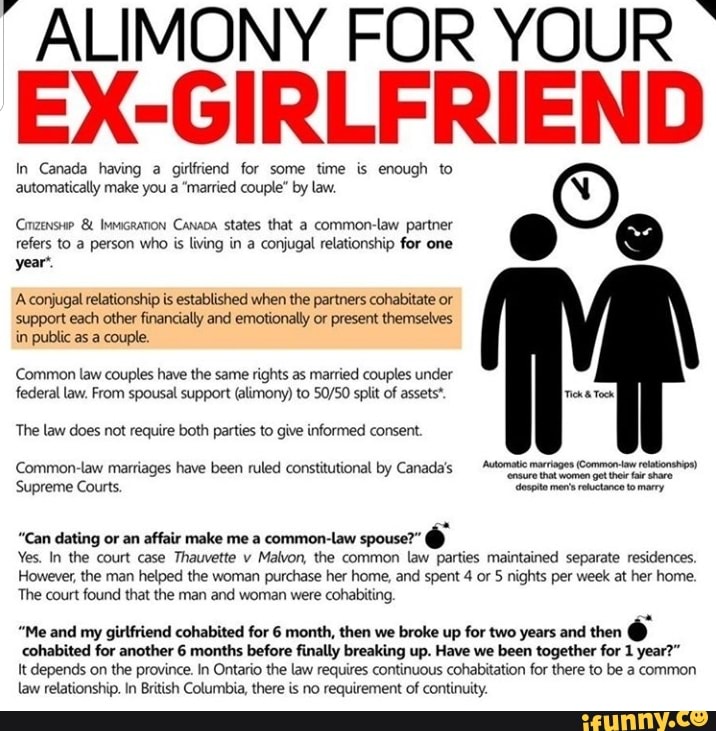

Alimony For Your X Girlfriend In Canada Having A Girlfriend For Some Time Is Enough To

The Difference Between Chapter 7 And Chapter 13 Bankruptcy Chapter 13 Bankruptcy Home Equity Line

Alimony Spousal Support Canadiandivorcelaws Com

What Is Spousal Support In Canada

Canadian Court Asks Man To Pay 53 000 Per Month To Ex Girlfriend As Spousal Support Mens Day Out

Alimony Celebrity Divorce Child Custody Child Support Children Divorce Collaborative Divorce Cost Of Divorce Div Divorce And Kids Divorce Help Divorce

Complete Tax Guide For Divorcees Cloudtax Simple Tax Application

Child Support Does Not End At Age 18 John P Schuman C S Child And Family Law John P Schuman Family Law Family Court Child Support Laws